The triple piggy bank

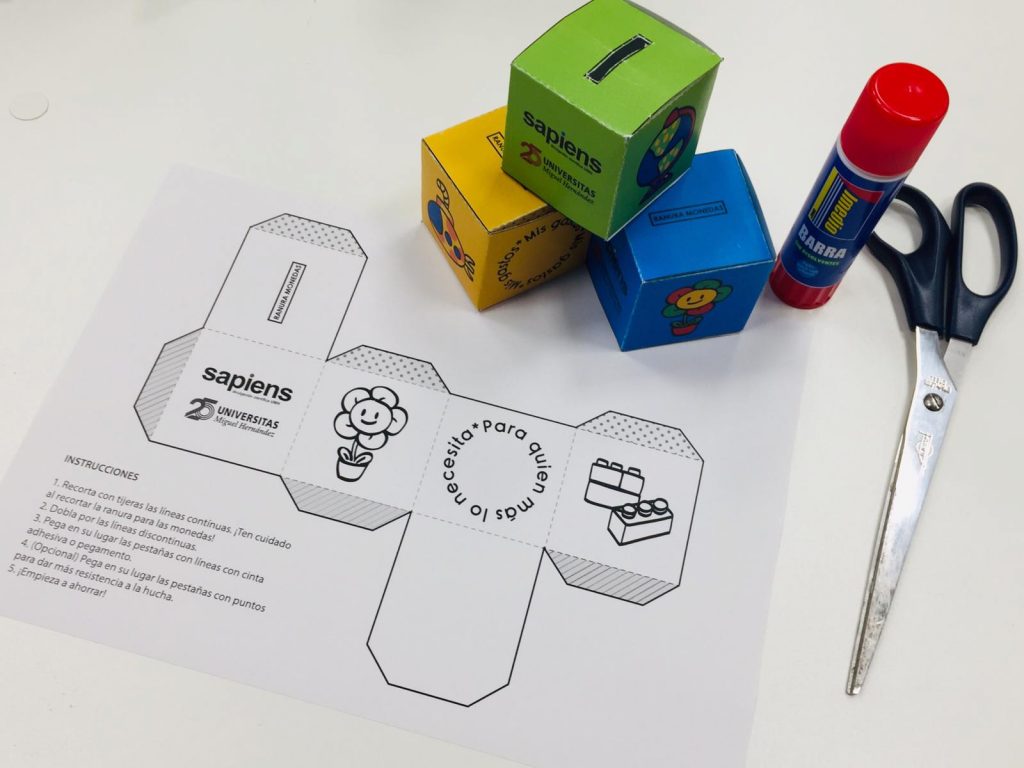

In this Science at Home activity, we are going to build three piggy banks to understand three of the different purposes that money can have: save, spend, or donate. You will be able to build your own piggy banks, decorate them, and understand (finally!) why grown-ups say things like “Do you think money grows on trees?”, “That’s bread for today and hunger for tomorrow” or “Who gives a lot, receives a lot”. Download here the piggy bank templates to print in color or black and white.

A piggy bank is an object with a slot in which money (coins, banknotes) is stored in order to save. Many times, it is shaped like a pig. Why is it in the shape of this animal? In the Middle Ages, in Europe, less fortunate people did not usually eat meat. But many families kept a pig so that they could sell it in case of need. Thus, it is said that the pig became a symbol of savings and reserves for the future.

Why is saving useful?

Saving is keeping part of the money received to spend later. Whether or not you can save depends on many factors: age, tastes, incomes, necessary expenses, and how far-sighted you are. Savings is part of the money that we have and do not spend immediately. A country, a company, or a person who saves can avoid problems in the future, face unforeseen events or improve their lives.

How can you save?

A person or family has fixed expenses: the cost of food, running water, electricity, transport, housing, and other aspects necessary for their day-to-day life. The income, the money they receive, must be more than those fixed expenses. The difference (income minus fixed expenses) is money that can be spent on things that are not essential or saved or invested.

What are expenses?

Expenses are what we spend money on. In a family, the expenses can be electricity or food. Companies also spend, to make products or pay their employees. The State spends money to build hospitals and roads or pay your teachers at the public school, for example.

One thing you can do in order to save is to reduce fixed expenses. To go grocery shopping, you can write down the prices of the products in the shops in your neighborhood and buy the cheapest ones. For example:

| Shopping list | Shop 1 | Shop 2 |

| A dozen eggs | 2,25€ | 1,55€ |

| A liter of milk | 1,20€ | 1,18€ |

| Loaf of bread | 0,50€ | 0,75€ |

| A kilo of oranges | 1,05€ | 0,64€ |

| A liter of olive oil | 5,30€ | 4,75€ |

Where should you buy the eggs to spend less money? How much would the purchase at store 1 cost? And in store 2? Where would you go shopping to spend less money?

What is money?

The coins and banknotes of any country in the world are money. Beware, Monopoly banknotes don’t count! We created money to facilitate the exchange of objects between people. Before, barter was used, some things were exchanged for others. For example, a chicken was exchanged for a sack of wheat or a pair of shoes. Besides earning, spending, and saving, you can do other things with money.

Taxes

Taxes are money that citizens pay to the State in order to have common services such as roads, hospitals or schools. There are several types of taxes. For example, value added tax or VAT is paid every time you buy something. A portion of what your purchase costs is money that the seller will send to the State. You can see it on the store receipt. Have you noticed that not all items have the same VAT? Try to find out why.

Investments

An investment is made (contribute money, work, or time to something) in exchange for a benefit. An investment has risks, which can be high (more risk of losing the investment) or low (less risk of losing the investment). Investments, too, have an opportunity cost, because we are deciding not to spend our money or time on something else.

Donations

Donating means transmitting goods that belong to us to other people. You can donate money, things, or time. Whoever receives and accepts that good or service is called a donee. In our day-to-day life, it is good to think of donation as something every day, as an expense, or as another task that we do willingly. Ask your family who they think could benefit from a donation and talk about the possibilities you have to help.

We suggest that you build your triple piggy bank following the instructions and think of a plan to save, spend and donate. For example, if you receive a weekly payment of four euros (€4) for performing certain tasks, how could you distribute them in your three piggy banks? If your grandparents gave you twenty euros (€20) for your birthday, what would you do? Remember that money is not an end but a means to achieve other things and that the sooner you learn to handle it responsibly, the easier it will be for you to manage your finances in the future.

With the collaboration of Fundación Española para la Ciencia y la Tecnología-Ministerio de Ciencia e Innovación.

Did you like these activities? You have many more available, for young and old, in the special ‘Science in your living room.